The worst case scenario is that PEAK OIL has already passed

and by 2025/30 the world will be getting along with 33% less oil for a rapidly

increasing demand. That is only 12 to 17 years away. This clearly

indicates steadily rising prices in the cost of Oil.

What is that going to do to us economically?

What is it going to do given the already terrible numbers above? Add to the grim numbers above the best estimates of Oil Depletion

What is that going to do to us economically?

What is it going to do given the already terrible numbers above? Add to the grim numbers above the best estimates of Oil Depletion

All experts agree that world oil production will peak

before the year 2015. What happens then?

Future Shortages—Rising worldwide demand for oil

will collide with falling availability. Governments, corporations, and

individuals will compete for that shrinking supply. The oil industry directly

controls a sixth of the world’s economy. More than 25 percent of ship traffic

on the world’s oceans is carrying oil; thousands of huge tankers churn through

the waters night and day. Diesel-burning trucks carry 70 percent of U.S.

products. Petro-burning planes, trains, and ships carry the rest. So prices of

just about everything will rise, because just about everything has a fossil

fuel energy component in its pricing. And, since petroleum energy is used to

produce oil, whenever the selling price of oil rises, the cost of producing oil

will also rise, possibly triggering another rise in the selling price of oil.

The assumption that we will simply pay more for the same

amount of fuel is naive. Year after year, once this process starts, more and

more people must manage with less and less fossil energy for heating, cooking,

driving, and generating electricity. Most fossil fuel supply experts project a

future in which world crude oil supply drops two to five percent per year,

starting the year after Hubbert’s worldwide peak. Here are some wild guesses as

to the timing and amount of future shortages. If it happens in 2005:

in 2015, the world’s economy must get along on 20% less oil;

by 2025, they must use 33% less;

by 2035, they make do with 50% less;

by 2045, 75% less; by 2060, 99% less.

If the peak happens in 2015:

by 2030, people must manage on 33% less oil;

in 2045, they have 50% less; in 2060, they have 75% less.

in 2015, the world’s economy must get along on 20% less oil;

by 2025, they must use 33% less;

by 2035, they make do with 50% less;

by 2045, 75% less; by 2060, 99% less.

If the peak happens in 2015:

by 2030, people must manage on 33% less oil;

in 2045, they have 50% less; in 2060, they have 75% less.

There is one potential delayer for this grim depletion

chronology afflicting conventional oil deposits: oil sand. There are huge

deposts of tar-sands oil in Alberta, Canada, and in the Orinoco belt of

Venzuela The oil potential in tar-sand is said to equal more than the entire

world’s original supply of regular crude. Facing the coming shortage, Shell,

Chevron, and companies from China, Israel, Japan, and Korea are investing in

extracting oil from tar sands. This type of oil is very difficult to extract,

requiring natural gas and other oil-derived stuff to get the stuff and to

process it into anything more sophisticated than asphalt. A new type of

refinery is necessary; for $2.5 billion such a refinery is being built in

Alberta. Although getting oil from tar sands consumes two-thirds of the energy

those sands ultimately yield, requires and then pollutes huge amounts of fresh

water, and releases six times as much carbon dioxide into the air as the

refining of conventional oil, the industry is turning in this direction. There

is enough oil in tar sands to extract for as long as centuries more, but

experts suggest that the rate of production cannot equal the present use of conventionally-extracted

crude. We can be sure that the price of fossil fuels will rise as more

challenging types of deposits are mined, at ever greater costs. The huge

deposits of “oil shale in Colorado are probably not going to help. The rock

called “oil shale” by promoters is not a real shale. It is organic marlstone.

There is no oil in it. It does contain a solid organic substance named kerogen.

The production of oil from kerogen currently requires mining, transport,

heating to 900 F., adding hydrogen, and disposing of waste. It takes huge

amounts of pure water, a substance scarcer in Colorado right now than oil. All

extraction and “refining” attempts so far, including recent efforts by Chevron,

Exxon, Occidental Petroleum, and Unocal, have failed.

We should not expect a sudden transition from great abundance to complete exhaustion of these resources. Various more-gradual scenarios are more plausible, as discussed below. However, the straight-line analysis presented in reference 1 remains useful, because (among other things) it sets the timescale on which something big must happen.

There are various possible outcomes, all of which depend

on the interplay of various factors:

·

Causative factor A: Depletion of the super-low-priced

sources raises the market price.

·

Causative factor B: One could imagine taxation in

anticipation of future shortages, so as to raise the market price.

·

Causative factor C: The cost of warfare to secure

otherwise “cheap” oil raises the real cost. If we take the cost of the recent

wars, divided by the amount of oil imports, it imputes a modest increase in the

price per gallon. This is not large enough to greatly alter usage patterns. On

the other hand,

§

It is large enough to be noticeable. A trillion dollars

is nothing to sneeze at.

§

The next war might be more expensive.

§

The Iraq war has significantly reduced Iraq’s oil

production, contributing to upward pressure on prices. Various embargoes and

sanctions also tend to push prices up.

§

Wars contribute to instability throughout the region.

The overthrow of governments in somewhat-friendly producing nations could

greatly disrupt supplies.

§

Producing nations that are presently somewhat friendly

might come to disagree with US military policy, and could reduce production or

even organize a boycott. This has happened before: There was a boycott in 1967

and a more-effective boycott in 1973.

Any combination of factors (A,B,C) promote the following results (1,2,3,4):

1.

The most wasteful uses become unaffordable.

2.

Other uses continue at the higher price. For example, oil is a

feedstock for some chemical processes leading to “priceless” products. The

priceless uses of fossil resources will continue the longest.

3.

If you really have a priceless application for oil, you can

find renewable sources: corn, sunflower, whatever. Chemical processes can be

adapted to use less-than-ideal feedstocks. The price goes up, but the priceless

uses continue.

4.

Non-oil sources of power that are currently uncompetitive

(e.g. solar power plants) become commercially viable.

We should also consider the following:

·

Causative factor D: The cost of solar power plants

falls due to the march of technology. It should fall relatively quickly compared

to the more-mature fossil-fuel power technology. This further promotes result

#4. And high-volume deployment should accelerate the march of technology,

creating a positive-feedback loop.stimated versus

Proven Reserves

For a discussion of the various types of

estimates, see reference 2.

The main types are

·

proven reserves

·

probable reserves

·

possible reserves

Scientific calculations

should be done using the best available data. When it comes to estimating the

amount of oil on earth, the “proven reserves” are not the best data.

Also, the reserves at the

“current” time is not the most sensible way to approach the problem, because

that will change as a function of time due to consumption if nothing else.

Instead, it makes more sense to ask how much oil was on earth at a fixed epoch,

e.g. 1950 or 1980. Call this the endowment at

the specified epoch.

One would expect the proven

reserves to increase over time, as more “proof” becomes available. But this

does not mean the endowment is increasing. There is absolutely no reason to

think any significant amount of oil is being created.

So the sensible approach is

to establish a best estimate of the endowment. This estimate will be a

probability distribution, with some width around a central value. There is no

reason to expect the central value to change significantly as a function of time.

As more evidence accumulates over time, the width of the probability

distribution should decrease, and the central value will undergo a small random

walk, but the central value should not exhibit any systematic drift. (If the

central value does drift, it means you’ve been using unsound estimation

procedures. You should be embarrassed. Go back to square one and re-do

everything using sound estimation methods, so this problem never recurs.)

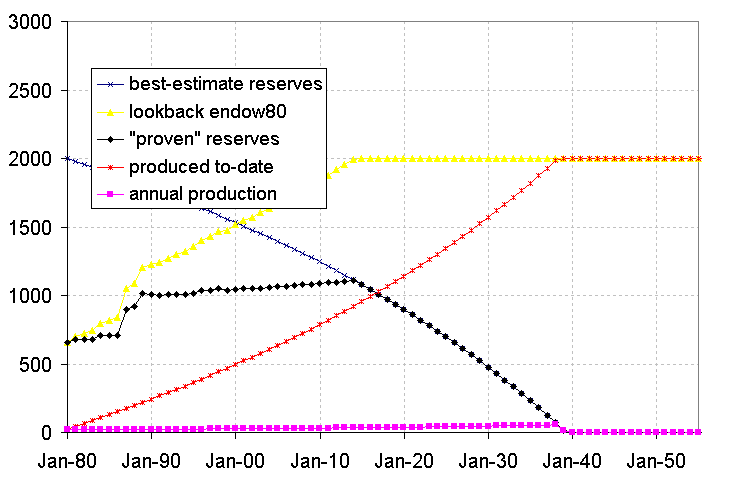

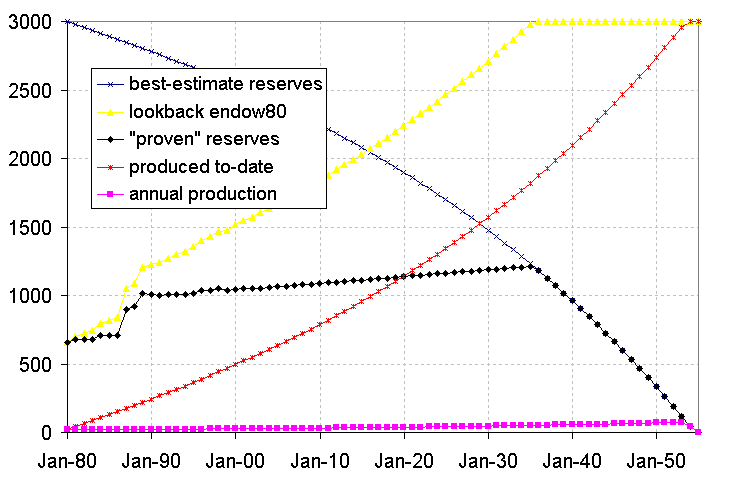

Figure 1 Oil Statistics Low Scenario

We can use figure 1 and figure 2 to get

an idea of what might be going on. We do the analysis twice, because of the

uncertainty in the endowment. For a summary of reported estimates, see reference 3. Quite a

few authors favor a figure of about 2000 Gb (for the year 1980), although some

estimates run as high as 3000 Gb or slightly higher. It is not entirely clear

whether the disagreements stem from different interpretations of the same raw

data (for instance, different decisions as to whether to include oil that is

extremely hard to recover) or simply uncertainty in the raw data.

·

In these figures, the

abscissa is time, starting in 1980 and running through 2055. The ordinate is

gigabarrels of oil.

·

The magenta curve

hugging the bottom of the graph is the annual production rate. This uses data

from reference 4 up

to 2002, and then extrapolates assuming a 2% annual growth rate until the

resource is exhausted.

·

The red curve from lower

left to upper right is the total amount of oil produced since 1980. It is

calculated by integrating the magenta curve.

·

The smooth curve from upper

left to lower right is the best estimate of oil remaining in the world. It is

calculated by starting with an estimate of the endowment in 1980 and

subtracting the amount produced since then.

·

The black curve that is

relatively horizontal near the middle of the graph represents the “proven”

reserves. This uses data from reference 4 up to 2002, and then

extrapolates using a rather arbitrary slope of +5 Gb per year. However, the “proven”

reserves cannot possibly exceed the actual reserves, so some time soon, the

“proven” reserves must start decreasing. This happens around 2015 in the low

scenario, but not until 2035 in the high scenario.

A huge jump in these

“proven” reserves occurred in the late 1980s. This jump was not due to the

creation of new oil molecules, nor even the discovery of hitherto-unexplored

oil fields; instead it was a paperwork exercise carried out for political

reasons. During a period of slack demand, OPEC members wanted to increase their

claimed reserves in order to argue for larger OPEC production quotas.

·

Finally, the yellow

curve illustrates the fallacy of using the “proven” reserves as an estimate of

actual reserves. The yellow curve is a lame estimate of the amount of oil

existing in 1980, prepared by taking the “proven” reserves at time t and

adding the amount of oil produced between 1980 and time t. The fact

that this estimate changes as a function of t is proof that it

is bogus. The actual endowment of oil molecules existing in 1980 is a constant.

In the “low scenario” as

described in figure 1, in 1980

the earth had 2000 Gb of oil, of which only 1/3rd was classified as

“proven” reserves. In 2003, the world had 1530 Gb of oil, of which 2/3rds was

classified as “proven” reserves.

Despite the recent history

of increases in “proven” reserves, it would be quite foolish to attempt to

extrapolate such increases beyond the short-term future. Actual reserves are

going down, even if “proven” reserves are going up in the short term. Proven

reserves can never exceed 100% of actual reserves.

This section has analyzed

the “proven” reserves of oil in some detail, partly because the oil industry

seems so suffer the most from the “proven” reserves fallacy ... but similar

thoughts apply to the total energy endowment. Coal will last longer than oil,

but not a lot longer.

And as discussed in section 1, we do not

actually expect current trends to continue until reserves crash to zero; we

expect people to wise up and change their behavior before then.

We can predict with high

confidence that something big

will happen to overall energy usage in the next 75 years or less, and something

big will happen to oil usage in the next 40 to 50 years or less. We cannot

predict exactly what will happen, because the details depend on choices that

have yet to be made.

From

the Data

You will find the BP Statistics used by OPEC here as a spreadsheet

And HERE IN THE COMPLETE REPORT that will download as an exel document

I think I will take BP’s word for it over some absurdist BS by cferaaro

Energy statistics can be very controversial - according to a story published today:

You will find the BP Statistics used by OPEC here as a spreadsheet

And HERE IN THE COMPLETE REPORT that will download as an exel document

I think I will take BP’s word for it over some absurdist BS by cferaaro

Energy statistics can be very controversial - according to a story published today:

The world is much closer to running out of oil than official estimates admit, according to a whistleblower at the International Energy Agency who claims it has been deliberately underplaying a looming shortage for fear of triggering panic buying.

The amount of proven oil

reserves awaiting to be exploited fell last year for the first time in a

decade, according to the BP figures. The amount of crude left in the ground was

1.258trn barrels - 3bn less than last year.

These figures, revealed in

the BP

Statistical Review of World Energy, are probably the result of a

slump in drilling activity due to a fall in the price of oil last year - from

$150 per barrel to $30.

At today’s rate of use

however there is still enough oil to last the next 42 years, according to the

oil company although those concerned about Peak Oil say we are closer to

running out given demand is expected to rise strongly in the short-term.

BP’s Statistical Review is

used extensively by OPEC and others in the industry as a key text. This year’s

review shows coal consumption continuing to soar, especially in China, a 70%

year-on-year increase in solar capacity and contains a host of other energy

gems.

SO BP SAYS WE HAVE 42 YEARS BUT THEY ARE AN OIL COMPANY and may be being conservative in their estimates - what if it’s closer to 30 years?

They seem to be banking on reduced consumption due to emerging countries like Brazil, China, India etc having some interest in providing alternative fuel vehicles to an emerging middle class. But the US is still using 25% of the world energy supply and we have to compete for oil with these countries

Some point to the tar sands - already included in the BP reports as an identified source and part of the global reserves but the cost in greenhouse gasses to convert the bitumen to oil is horrendous - this trade off is a serious matter for concern with the Canadians. Trading the health of the planet for for money is less palatable for them than the right wingers in the US.

It’s going to be interesting to see how this works out. Is BP right? Do we have a 42 year supply? Or is their estimate too conservative - are there only 30 years left with declining supplies and increasing demand. Many on the right are betting our childrens lives on it.

SO BP SAYS WE HAVE 42 YEARS BUT THEY ARE AN OIL COMPANY and may be being conservative in their estimates - what if it’s closer to 30 years?

They seem to be banking on reduced consumption due to emerging countries like Brazil, China, India etc having some interest in providing alternative fuel vehicles to an emerging middle class. But the US is still using 25% of the world energy supply and we have to compete for oil with these countries

Some point to the tar sands - already included in the BP reports as an identified source and part of the global reserves but the cost in greenhouse gasses to convert the bitumen to oil is horrendous - this trade off is a serious matter for concern with the Canadians. Trading the health of the planet for for money is less palatable for them than the right wingers in the US.

It’s going to be interesting to see how this works out. Is BP right? Do we have a 42 year supply? Or is their estimate too conservative - are there only 30 years left with declining supplies and increasing demand. Many on the right are betting our childrens lives on it.

The oil companies have been

making record profits without copping to any scarcity haven’t they?

The truth of the matter is that they do have a significant handle on the oil reserves left in the world and can predict with excellent reliability the presence of oil in geological structures. They get better at it all the time.

The consumption of barrels of oil per day is currently 100,000,000 in 2012 Current reserves are calculated at 1,392,461,000,000 or 39 years worth at current consumption

That fits quite closely with BP’s 42 year estimate. Oil is such a profitable business and so sophisticated in the exploration and production techniques that it is difficult to argue with these numbers but one factor above all others makes the numbers suspect.

OPEC countries are tied to producing as a percentage of reserves and OPEC reserve reporting has seen a dramatic oddity - none of the OPEC countries have been reporting a drop in their reserves despite pumping billions of barrels out of the ground every year

“Most outside observers believe that the ‘official’ reserves of OPEC members are way overstated,” “Remember the last increase was in response to the OPEC quota agreement which allowed members to sell oil in proportion to their reserves - the bigger your reserves, the bigger your quota.”“There have been many scandals over the years from people overstating reserves to make them look richer and more important than they are,” added Whipple.“The biggest fuss I can recall was in Kuwait about five years ago, when somebody leaked a secret government study that said Kuwait’s reserves were less than half what they had been saying. After much fuss, the government made the whole issue even more secret and refused to answer further questions about the report.”Oil giant BP produces an annual statistical review containing a spreadsheet that has reported world oil reserves back to 1980.

“I’ve tracked that review for the world and for specific OPEC countries,” “Six countries account for more than 80 per cent of OPEC oil; Saudi [Arabia], Kuwait, Iraq, Iran, United Arab Emirates, and Venezuela, and all six of them jacked up their reserves by nearly 100 per cent between 1984 and 1988.” This was not based on anything but a need to overstate to raise their output quotas for the current leaders who did not care about anything but maximizing income NOW instead of later when they would not be around to spend the money.We all know that Saudi and other Arab princes are prolifigate spenders who build massive palaces and overseas homes while first turning Dubai into a skyscraper orgy that has fallen on hard timesas the people drawn to the boom are leaving their Ferrari’s and Mercedes in airport parking lots as they escape. Dubai once the heaven for the fabulously wealthy has fallen already and the once wealthy palace owning Sheiks will soon be back riding camels across a barren wasteland after squandering the greatest single asset in history. Nobody should weep for them but what this portends for the USA is another matter.

It is easy to see why the OPEC producers jack up their reserve reports so they can continue to produce the same or greater levels of oil each year - but it’s impossible to believe estimates that never drop the amount of reserves. For this reason alone it should be suspected that the numbers are inflated and not too conservative. Saudi Arabia is a case in point - production has been declining raising speculation about their reported reserves.

Washington fears Saudi Arabia overestimated its oil reserves by as much as 40 percent and the kingdom can’t keep enough oil flowing to control prices, U.S. diplomatic cables obtained by WikiLeaksThis puts a hole in speculation that reserves are being under reported to increase prices.

So what of this new Bakken reserve in ND and Canada - will it be our savior?

Well read it for yourself but it seem likely that this reserve will provide all the oil we need for one full year if we can overcome the obstacles to it’s recovery. The cost in water and air pollution is quite staggering.

In summary there is a whole lot we do know and much of that is not very encouraging. I hope you are right but the weight of intelligent and informed consideration is heavily stacked against you. It seems to me that 42 years of supply at current usage is the best there is and given a certain increase in use and a very likely overstatement of the reserves that 30 years is more likely at significant increases of costs for fuel and significant damage to the environment.

No comments:

Post a Comment