DUMBER IS BETTER FOR TEA PARTY KOCH ROACHES

Saving Rush Limbaughtomy sufferers One Mind at a Time.

May 22, 2012

May 21, 2012

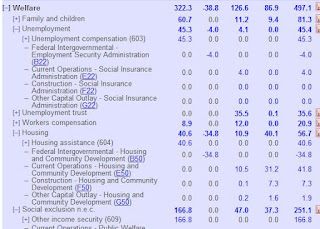

WELFARE

1992

When Clinton/Gore take office family & children get 32.6 billion in assistance and housing gets 18.9 for a total of 51.5 billion - unemployment stood at 39.5

1994

If we accept the generally understood carryover effect that suggests an new administration's efforts show up in the 2nd year following a carry over effect from the previous administration's policies we see that families and children got 36.8 and housing 23.9 two years into the Clinton Gore period while unemployment stood at 28.7

2000

\

\When Clinton/Gore leave office families and children get 32.5 billion and housing gets 28.9 total 61.4 billion increase of 10 and big decrease as % of GDP at 6,342.3 Billion in 1992 vs 9951.5 in 2000

Unemployment compensation dropped from 39.5 or 28.7 to 23.0 during Clinton Gore

2002

If we use 2002 as the starting point for W's effect on welfare and unemployment we get 38.2 and 33.3 for families and children and housing and 53.3 for unemployment

2006

After 6 years of total Republican control the families and children get 54 billion and the housing is 38.3 or a total of 92.3 billion on a GDP of 13.4 billion. This accompanies the massive Bush Tax cuts and profligate spending on two wars employing 1000's of soldiers and Halliburton KBR contractors and Blackwater mercenaries

and unemployment compensation is 33 from 53 billion over those 6 years given the massive number of troops, mercenaries, and KBR Halliburton employees raking in billions in Iraq and Afghanistans as we plunge into an addition 6 trillion in debt.

2008

But by 2008 Families and Children get 60.7 and housing 40.6 or 101.3 billion and the GDP is 14.4 billion and unemployment is up 45.3 from 33 during W even with the massive employment boom of IRAQ where soldiers and mercenaries and KBR 800 per hour truck drivers deliver 65 dollar cases of coke while former bus boys and waiters become mortgage agents selling houses to Bush's "ownership society" making their financial institutions filthy rich?

2010

In 2010 the real results of the W years take hold as families and children now get 95.1 and housing 58.7 total 153.8 on GDP of 14.5 billion but unemployment comp is now 160.1 billion up a whopping 137 billion since Clinton Gore left office.

Anyone wanting to blame the unemployment boom following the Bush financial collapse on Obama better get their GOOGLE in order to show how it was anything other than a miracle that he actually saved us from things getting much worse. Remember the job loss figures from 2000 thru 2008 and then until Obama passed the stimulus and recovery act that stemmed the unemployment tsunami.

Here are the real numbers so you explain how we got here via Barney and Dood.

or our permissive zero responsibility Demoncrats

or the machinations of the Marxists

or whatever conspiracy theory you need to explain how a relatively solvent and stable America in 2000 exploded into a Welfare State of many billions going to newly unemployed welfare "queens" who evidently procreated at an exceptional rate with the help of the anti-abortion dogmatic in order to bankrupt America in collusion with Barney and Dood

May 14, 2012

ROMNESIA - Did he forget the Bush years were a disaster?

There’s not much in politics that allows me to say, “I’m old enough to remember when.” But here’s one: I’m old enough to remember when George W. Bush was president.

George W. Bush’s economy was terrible. (ANDY CROSS - AP)

It was, after all, only four short years ago. And it didn’t go so well. The Bush economy is one of the worst on record. Median wages dropped. Poverty worsened. Inequality increased. Surpluses turned into deficits. Monthly job growth was weaker than it had been in any expansion since 1954. Economic growth was sluggish. And that’s before you count the financial crisis that unfurled on his watch. Add the collapse to the equation, and Bush’s record goes from “not so good” to “I can’t bear to look.”

Given all that, you’d think Republicans would be running from anything or anyone who even vaguely reminded Americans of our 43rd president. In fact, the GOP seems eager to get the old gang back together.

Last week, when CNN asked House Speaker John Boehner whom Mitt Romney, the likely GOP presidential nominee, should choose as his vice presidential running mate, he named Indiana Gov. Mitch Daniels, Ohio Sen. Rob Portman and Florida Sen. Marco Rubio. Daniels and Portman served as budget directors in the Bush White House. Perhaps more surprising, a variety of big-name Republicans haveopenly yearned for Jeb Bush to get the nod — and before that, to run for the nomination itself.

Meanwhile, Romney’s campaign staff is thick with Bush administration veterans. Two of his economic advisers — N. Greg Mankiw and Glenn Hubbard — served as chief economists for Bush. His policy director, Lanhee Chen, worked on health policy in the Bush White House.

Some of this is unavoidable: Presidential administrations tend to suck up a political party’s best talent. The Obama White House, for instance, is full of Clinton veterans. But in the Obama White House, the Clinton veterans haven’t really acted like Clinton veterans.

Where, in the 1990s, they were known for cutting the deficit and loosening regulations on the financial sector, they now applied themselves to crafting a deficit-financed stimulus package and re-regulating the financial sector. They arguably didn’t go far enough on either count. But they went further, certainly, than Congress expected to go. This was, they contended, a different time, and it required different policies — even though the Clinton record was broadly considered a success.

(Chart: Washington Post.)Romney's campaign rethink has been shallower. The candidate’s platform calls for extending all the Bush tax cuts and then adding more. It calls for repealing many of the new financial regulations but says nothing about what it would put in their place. The difference is that Romney talks much more about deficit reduction than Bush did and spends much less time emphasizing policies to reform the education system or expand health-care options for seniors. Where Bush sold himself as a “compassionate conservative,” Romney has sold himself as “severely conservative.”

Still, there’s little that couldn’t have been there in 2000, or 1996, or 1988. Reading Romney’s policies, you would never know that the nation is still facing high unemployment rates or that it just came through the worst financial crisis in a generation. You certainly wouldn’t think we’d just emerged from a decade in which large tax cuts and financial deregulation led to major economic distress.

This is not necessarily the fault of Romney’s advisers, who have rethought elements of the Republican Party platform and have taken risks. Mankiw, for instance, has eloquently argued for a tax on carbon emissions and for a looser monetary policy. Hubbard has pushed efforts to encourage mass refinancing. Vin Weber, another Romney adviser, was an advocate of the Bowles-Simpson deficit-reduction plan. But Romney hasn’t gone for any of these policies. There’s nothing in his campaign platform that couldn’t have been in Bush’s platform. In fact, most of it was.

The irony of this is that, of late, the Obama camp is reverting to more traditionally Clintonian policies. Now that the worst of the crisis is over, the president’s advisers are pushing harder for a deficit-reduction package. Now that they’re facing a Republican Congress that doesn’t want to give an inch, they’re pushing more small, high-polling policy ideas — the very “politics of school uniforms” for which they once derided Clinton’s campaign. Now that the Bush tax cuts are set to expire, they’re arguing for letting the rates on the rich revert to Clinton-era levels. They’re even sending Clinton out to campaign for Obama. The election might end up being Bush vs. Clinton, even as it most likely will be between Obama and Romney.

That could be a problem for the Romney campaign. Because just as most voters remember the Bush years, they remember the Clinton years, too. And they liked them a lot more.

May 6, 2012

Are We Running Out of OIL?

Add to the grim numbers below these best estimates of Oil Depletion

We should not expect a sudden transition from great abundance to complete exhaustion of these resources. Various more-gradual scenarios are more plausible, as discussed below. However, the straight-line analysis presented in reference 1 remains useful, because (among other things) it sets the timescale on which something big must happen.

For a discussion of the various types of

estimates, see reference 2.

The main types are

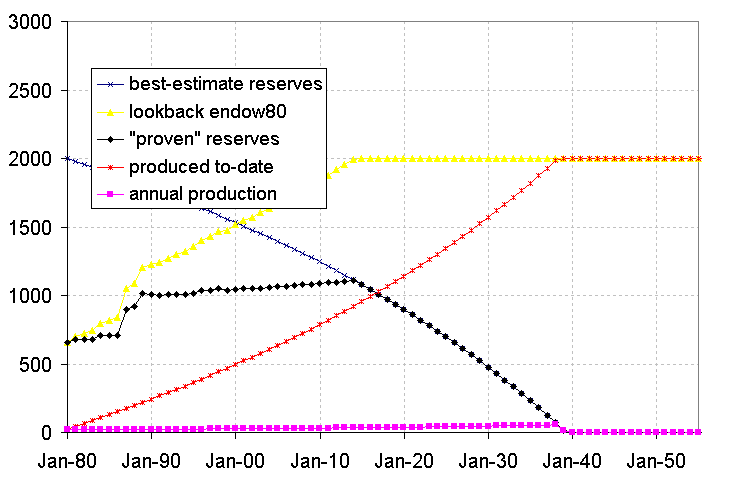

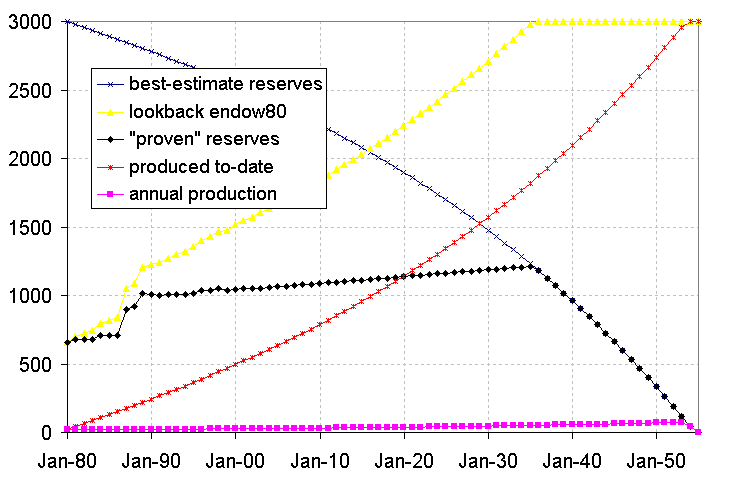

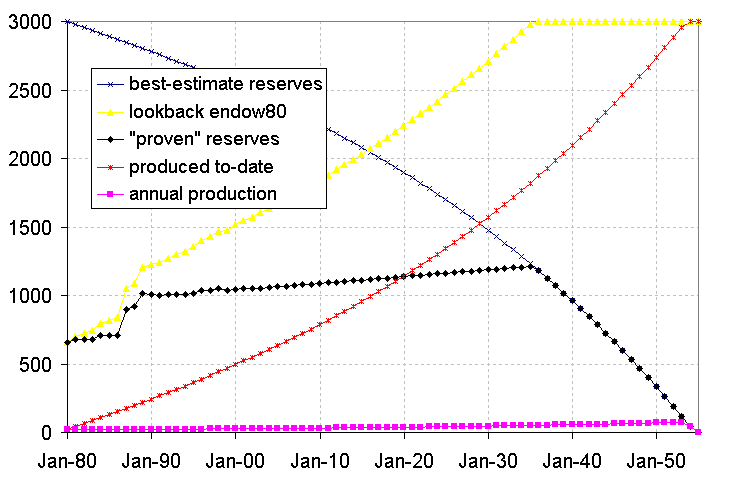

Figure 1 Oil Statistics Low Scenario

The truth of the matter is that they do have a significant handle on the oil reserves left in the world and can predict with excellent reliability the presence of oil in geological structures. They get better at it all the time.

The consumption of barrels of oil per day is currently 100,000,000 in 2012 Current reserves are calculated at 1,392,461,000,000 or 39 years worth at current consumption

That fits quite closely with BP’s 42 year estimate. Oil is such a profitable business and so sophisticated in the exploration and production techniques that it is difficult to argue with these numbers but one factor above all others makes the numbers suspect.

OPEC countries are tied to producing as a percentage of reserves and OPEC reserve reporting has seen a dramatic oddity - none of the OPEC countries have been reporting a drop in their reserves despite pumping billions of barrels out of the ground every year

It is easy to see why the OPEC producers jack up their reserve reports so they can continue to produce the same or greater levels of oil each year - but it’s impossible to believe estimates that never drop the amount of reserves. For this reason alone it should be suspected that the numbers are inflated and not too conservative. Saudi Arabia is a case in point - production has been declining raising speculation about their reported reserves.

So what of this new Bakken reserve in ND and Canada - will it be our savior?

Well read it for yourself but it seem likely that this reserve will provide all the oil we need for one full year if we can overcome the obstacles to it’s recovery. The cost in water and air pollution is quite staggering.

In summary there is a whole lot we do know and much of that is not very encouraging. I hope you are right but the weight of intelligent and informed consideration is heavily stacked against you. It seems to me that 42 years of supply at current usage is the best there is and given a certain increase in use and a very likely overstatement of the reserves that 30 years is more likely at significant increases of costs for fuel and significant damage to the environment.

The worst case scenario is that PEAK OIL has already passed

and by 2025/30 the world will be getting along with 33% less oil for a rapidly

increasing demand. That is only 12 to 17 years away. This clearly

indicates steadily rising prices in the cost of Oil.

What is that going to do to us economically?

What is it going to do given the already terrible numbers above? Add to the grim numbers above the best estimates of Oil Depletion

What is that going to do to us economically?

What is it going to do given the already terrible numbers above? Add to the grim numbers above the best estimates of Oil Depletion

All experts agree that world oil production will peak

before the year 2015. What happens then?

Future Shortages—Rising worldwide demand for oil

will collide with falling availability. Governments, corporations, and

individuals will compete for that shrinking supply. The oil industry directly

controls a sixth of the world’s economy. More than 25 percent of ship traffic

on the world’s oceans is carrying oil; thousands of huge tankers churn through

the waters night and day. Diesel-burning trucks carry 70 percent of U.S.

products. Petro-burning planes, trains, and ships carry the rest. So prices of

just about everything will rise, because just about everything has a fossil

fuel energy component in its pricing. And, since petroleum energy is used to

produce oil, whenever the selling price of oil rises, the cost of producing oil

will also rise, possibly triggering another rise in the selling price of oil.

The assumption that we will simply pay more for the same

amount of fuel is naive. Year after year, once this process starts, more and

more people must manage with less and less fossil energy for heating, cooking,

driving, and generating electricity. Most fossil fuel supply experts project a

future in which world crude oil supply drops two to five percent per year,

starting the year after Hubbert’s worldwide peak. Here are some wild guesses as

to the timing and amount of future shortages. If it happens in 2005:

in 2015, the world’s economy must get along on 20% less oil;

by 2025, they must use 33% less;

by 2035, they make do with 50% less;

by 2045, 75% less; by 2060, 99% less.

If the peak happens in 2015:

by 2030, people must manage on 33% less oil;

in 2045, they have 50% less; in 2060, they have 75% less.

in 2015, the world’s economy must get along on 20% less oil;

by 2025, they must use 33% less;

by 2035, they make do with 50% less;

by 2045, 75% less; by 2060, 99% less.

If the peak happens in 2015:

by 2030, people must manage on 33% less oil;

in 2045, they have 50% less; in 2060, they have 75% less.

There is one potential delayer for this grim depletion

chronology afflicting conventional oil deposits: oil sand. There are huge

deposts of tar-sands oil in Alberta, Canada, and in the Orinoco belt of

Venzuela The oil potential in tar-sand is said to equal more than the entire

world’s original supply of regular crude. Facing the coming shortage, Shell,

Chevron, and companies from China, Israel, Japan, and Korea are investing in

extracting oil from tar sands. This type of oil is very difficult to extract,

requiring natural gas and other oil-derived stuff to get the stuff and to

process it into anything more sophisticated than asphalt. A new type of

refinery is necessary; for $2.5 billion such a refinery is being built in

Alberta. Although getting oil from tar sands consumes two-thirds of the energy

those sands ultimately yield, requires and then pollutes huge amounts of fresh

water, and releases six times as much carbon dioxide into the air as the

refining of conventional oil, the industry is turning in this direction. There

is enough oil in tar sands to extract for as long as centuries more, but

experts suggest that the rate of production cannot equal the present use of conventionally-extracted

crude. We can be sure that the price of fossil fuels will rise as more

challenging types of deposits are mined, at ever greater costs. The huge

deposits of “oil shale in Colorado are probably not going to help. The rock

called “oil shale” by promoters is not a real shale. It is organic marlstone.

There is no oil in it. It does contain a solid organic substance named kerogen.

The production of oil from kerogen currently requires mining, transport,

heating to 900 F., adding hydrogen, and disposing of waste. It takes huge

amounts of pure water, a substance scarcer in Colorado right now than oil. All

extraction and “refining” attempts so far, including recent efforts by Chevron,

Exxon, Occidental Petroleum, and Unocal, have failed.

We should not expect a sudden transition from great abundance to complete exhaustion of these resources. Various more-gradual scenarios are more plausible, as discussed below. However, the straight-line analysis presented in reference 1 remains useful, because (among other things) it sets the timescale on which something big must happen.

There are various possible outcomes, all of which depend

on the interplay of various factors:

·

Causative factor A: Depletion of the super-low-priced

sources raises the market price.

·

Causative factor B: One could imagine taxation in

anticipation of future shortages, so as to raise the market price.

·

Causative factor C: The cost of warfare to secure

otherwise “cheap” oil raises the real cost. If we take the cost of the recent

wars, divided by the amount of oil imports, it imputes a modest increase in the

price per gallon. This is not large enough to greatly alter usage patterns. On

the other hand,

§

It is large enough to be noticeable. A trillion dollars

is nothing to sneeze at.

§

The next war might be more expensive.

§

The Iraq war has significantly reduced Iraq’s oil

production, contributing to upward pressure on prices. Various embargoes and

sanctions also tend to push prices up.

§

Wars contribute to instability throughout the region.

The overthrow of governments in somewhat-friendly producing nations could

greatly disrupt supplies.

§

Producing nations that are presently somewhat friendly

might come to disagree with US military policy, and could reduce production or

even organize a boycott. This has happened before: There was a boycott in 1967

and a more-effective boycott in 1973.

Any combination of factors (A,B,C) promote the following results (1,2,3,4):

1.

The most wasteful uses become unaffordable.

2.

Other uses continue at the higher price. For example, oil is a

feedstock for some chemical processes leading to “priceless” products. The

priceless uses of fossil resources will continue the longest.

3.

If you really have a priceless application for oil, you can

find renewable sources: corn, sunflower, whatever. Chemical processes can be

adapted to use less-than-ideal feedstocks. The price goes up, but the priceless

uses continue.

4.

Non-oil sources of power that are currently uncompetitive

(e.g. solar power plants) become commercially viable.

We should also consider the following:

·

Causative factor D: The cost of solar power plants

falls due to the march of technology. It should fall relatively quickly compared

to the more-mature fossil-fuel power technology. This further promotes result

#4. And high-volume deployment should accelerate the march of technology,

creating a positive-feedback loop.stimated versus

Proven Reserves

For a discussion of the various types of

estimates, see reference 2.

The main types are

·

proven reserves

·

probable reserves

·

possible reserves

Scientific calculations

should be done using the best available data. When it comes to estimating the

amount of oil on earth, the “proven reserves” are not the best data.

Also, the reserves at the

“current” time is not the most sensible way to approach the problem, because

that will change as a function of time due to consumption if nothing else.

Instead, it makes more sense to ask how much oil was on earth at a fixed epoch,

e.g. 1950 or 1980. Call this the endowment at

the specified epoch.

One would expect the proven

reserves to increase over time, as more “proof” becomes available. But this

does not mean the endowment is increasing. There is absolutely no reason to

think any significant amount of oil is being created.

So the sensible approach is

to establish a best estimate of the endowment. This estimate will be a

probability distribution, with some width around a central value. There is no

reason to expect the central value to change significantly as a function of time.

As more evidence accumulates over time, the width of the probability

distribution should decrease, and the central value will undergo a small random

walk, but the central value should not exhibit any systematic drift. (If the

central value does drift, it means you’ve been using unsound estimation

procedures. You should be embarrassed. Go back to square one and re-do

everything using sound estimation methods, so this problem never recurs.)

Figure 1 Oil Statistics Low Scenario

We can use figure 1 and figure 2 to get

an idea of what might be going on. We do the analysis twice, because of the

uncertainty in the endowment. For a summary of reported estimates, see reference 3. Quite a

few authors favor a figure of about 2000 Gb (for the year 1980), although some

estimates run as high as 3000 Gb or slightly higher. It is not entirely clear

whether the disagreements stem from different interpretations of the same raw

data (for instance, different decisions as to whether to include oil that is

extremely hard to recover) or simply uncertainty in the raw data.

·

In these figures, the

abscissa is time, starting in 1980 and running through 2055. The ordinate is

gigabarrels of oil.

·

The magenta curve

hugging the bottom of the graph is the annual production rate. This uses data

from reference 4 up

to 2002, and then extrapolates assuming a 2% annual growth rate until the

resource is exhausted.

·

The red curve from lower

left to upper right is the total amount of oil produced since 1980. It is

calculated by integrating the magenta curve.

·

The smooth curve from upper

left to lower right is the best estimate of oil remaining in the world. It is

calculated by starting with an estimate of the endowment in 1980 and

subtracting the amount produced since then.

·

The black curve that is

relatively horizontal near the middle of the graph represents the “proven”

reserves. This uses data from reference 4 up to 2002, and then

extrapolates using a rather arbitrary slope of +5 Gb per year. However, the “proven”

reserves cannot possibly exceed the actual reserves, so some time soon, the

“proven” reserves must start decreasing. This happens around 2015 in the low

scenario, but not until 2035 in the high scenario.

A huge jump in these

“proven” reserves occurred in the late 1980s. This jump was not due to the

creation of new oil molecules, nor even the discovery of hitherto-unexplored

oil fields; instead it was a paperwork exercise carried out for political

reasons. During a period of slack demand, OPEC members wanted to increase their

claimed reserves in order to argue for larger OPEC production quotas.

·

Finally, the yellow

curve illustrates the fallacy of using the “proven” reserves as an estimate of

actual reserves. The yellow curve is a lame estimate of the amount of oil

existing in 1980, prepared by taking the “proven” reserves at time t and

adding the amount of oil produced between 1980 and time t. The fact

that this estimate changes as a function of t is proof that it

is bogus. The actual endowment of oil molecules existing in 1980 is a constant.

In the “low scenario” as

described in figure 1, in 1980

the earth had 2000 Gb of oil, of which only 1/3rd was classified as

“proven” reserves. In 2003, the world had 1530 Gb of oil, of which 2/3rds was

classified as “proven” reserves.

Despite the recent history

of increases in “proven” reserves, it would be quite foolish to attempt to

extrapolate such increases beyond the short-term future. Actual reserves are

going down, even if “proven” reserves are going up in the short term. Proven

reserves can never exceed 100% of actual reserves.

This section has analyzed

the “proven” reserves of oil in some detail, partly because the oil industry

seems so suffer the most from the “proven” reserves fallacy ... but similar

thoughts apply to the total energy endowment. Coal will last longer than oil,

but not a lot longer.

And as discussed in section 1, we do not

actually expect current trends to continue until reserves crash to zero; we

expect people to wise up and change their behavior before then.

We can predict with high

confidence that something big

will happen to overall energy usage in the next 75 years or less, and something

big will happen to oil usage in the next 40 to 50 years or less. We cannot

predict exactly what will happen, because the details depend on choices that

have yet to be made.

From

the Data

You will find the BP Statistics used by OPEC here as a spreadsheet

And HERE IN THE COMPLETE REPORT that will download as an exel document

I think I will take BP’s word for it over some absurdist BS by cferaaro

Energy statistics can be very controversial - according to a story published today:

You will find the BP Statistics used by OPEC here as a spreadsheet

And HERE IN THE COMPLETE REPORT that will download as an exel document

I think I will take BP’s word for it over some absurdist BS by cferaaro

Energy statistics can be very controversial - according to a story published today:

The world is much closer to running out of oil than official estimates admit, according to a whistleblower at the International Energy Agency who claims it has been deliberately underplaying a looming shortage for fear of triggering panic buying.

The amount of proven oil

reserves awaiting to be exploited fell last year for the first time in a

decade, according to the BP figures. The amount of crude left in the ground was

1.258trn barrels - 3bn less than last year.

These figures, revealed in

the BP

Statistical Review of World Energy, are probably the result of a

slump in drilling activity due to a fall in the price of oil last year - from

$150 per barrel to $30.

At today’s rate of use

however there is still enough oil to last the next 42 years, according to the

oil company although those concerned about Peak Oil say we are closer to

running out given demand is expected to rise strongly in the short-term.

BP’s Statistical Review is

used extensively by OPEC and others in the industry as a key text. This year’s

review shows coal consumption continuing to soar, especially in China, a 70%

year-on-year increase in solar capacity and contains a host of other energy

gems.

SO BP SAYS WE HAVE 42 YEARS BUT THEY ARE AN OIL COMPANY and may be being conservative in their estimates - what if it’s closer to 30 years?

They seem to be banking on reduced consumption due to emerging countries like Brazil, China, India etc having some interest in providing alternative fuel vehicles to an emerging middle class. But the US is still using 25% of the world energy supply and we have to compete for oil with these countries

Some point to the tar sands - already included in the BP reports as an identified source and part of the global reserves but the cost in greenhouse gasses to convert the bitumen to oil is horrendous - this trade off is a serious matter for concern with the Canadians. Trading the health of the planet for for money is less palatable for them than the right wingers in the US.

It’s going to be interesting to see how this works out. Is BP right? Do we have a 42 year supply? Or is their estimate too conservative - are there only 30 years left with declining supplies and increasing demand. Many on the right are betting our childrens lives on it.

SO BP SAYS WE HAVE 42 YEARS BUT THEY ARE AN OIL COMPANY and may be being conservative in their estimates - what if it’s closer to 30 years?

They seem to be banking on reduced consumption due to emerging countries like Brazil, China, India etc having some interest in providing alternative fuel vehicles to an emerging middle class. But the US is still using 25% of the world energy supply and we have to compete for oil with these countries

Some point to the tar sands - already included in the BP reports as an identified source and part of the global reserves but the cost in greenhouse gasses to convert the bitumen to oil is horrendous - this trade off is a serious matter for concern with the Canadians. Trading the health of the planet for for money is less palatable for them than the right wingers in the US.

It’s going to be interesting to see how this works out. Is BP right? Do we have a 42 year supply? Or is their estimate too conservative - are there only 30 years left with declining supplies and increasing demand. Many on the right are betting our childrens lives on it.

The oil companies have been

making record profits without copping to any scarcity haven’t they?

The truth of the matter is that they do have a significant handle on the oil reserves left in the world and can predict with excellent reliability the presence of oil in geological structures. They get better at it all the time.

The consumption of barrels of oil per day is currently 100,000,000 in 2012 Current reserves are calculated at 1,392,461,000,000 or 39 years worth at current consumption

That fits quite closely with BP’s 42 year estimate. Oil is such a profitable business and so sophisticated in the exploration and production techniques that it is difficult to argue with these numbers but one factor above all others makes the numbers suspect.

OPEC countries are tied to producing as a percentage of reserves and OPEC reserve reporting has seen a dramatic oddity - none of the OPEC countries have been reporting a drop in their reserves despite pumping billions of barrels out of the ground every year

“Most outside observers believe that the ‘official’ reserves of OPEC members are way overstated,” “Remember the last increase was in response to the OPEC quota agreement which allowed members to sell oil in proportion to their reserves - the bigger your reserves, the bigger your quota.”“There have been many scandals over the years from people overstating reserves to make them look richer and more important than they are,” added Whipple.“The biggest fuss I can recall was in Kuwait about five years ago, when somebody leaked a secret government study that said Kuwait’s reserves were less than half what they had been saying. After much fuss, the government made the whole issue even more secret and refused to answer further questions about the report.”Oil giant BP produces an annual statistical review containing a spreadsheet that has reported world oil reserves back to 1980.

“I’ve tracked that review for the world and for specific OPEC countries,” “Six countries account for more than 80 per cent of OPEC oil; Saudi [Arabia], Kuwait, Iraq, Iran, United Arab Emirates, and Venezuela, and all six of them jacked up their reserves by nearly 100 per cent between 1984 and 1988.” This was not based on anything but a need to overstate to raise their output quotas for the current leaders who did not care about anything but maximizing income NOW instead of later when they would not be around to spend the money.We all know that Saudi and other Arab princes are prolifigate spenders who build massive palaces and overseas homes while first turning Dubai into a skyscraper orgy that has fallen on hard timesas the people drawn to the boom are leaving their Ferrari’s and Mercedes in airport parking lots as they escape. Dubai once the heaven for the fabulously wealthy has fallen already and the once wealthy palace owning Sheiks will soon be back riding camels across a barren wasteland after squandering the greatest single asset in history. Nobody should weep for them but what this portends for the USA is another matter.

It is easy to see why the OPEC producers jack up their reserve reports so they can continue to produce the same or greater levels of oil each year - but it’s impossible to believe estimates that never drop the amount of reserves. For this reason alone it should be suspected that the numbers are inflated and not too conservative. Saudi Arabia is a case in point - production has been declining raising speculation about their reported reserves.

Washington fears Saudi Arabia overestimated its oil reserves by as much as 40 percent and the kingdom can’t keep enough oil flowing to control prices, U.S. diplomatic cables obtained by WikiLeaksThis puts a hole in speculation that reserves are being under reported to increase prices.

So what of this new Bakken reserve in ND and Canada - will it be our savior?

Well read it for yourself but it seem likely that this reserve will provide all the oil we need for one full year if we can overcome the obstacles to it’s recovery. The cost in water and air pollution is quite staggering.

In summary there is a whole lot we do know and much of that is not very encouraging. I hope you are right but the weight of intelligent and informed consideration is heavily stacked against you. It seems to me that 42 years of supply at current usage is the best there is and given a certain increase in use and a very likely overstatement of the reserves that 30 years is more likely at significant increases of costs for fuel and significant damage to the environment.

May 5, 2012

VERY SCARY NUMBERS - Blame it on Bush?

There is plenty more

blame to go around & This may well scare the crap out of

you.

You may think this is crazy? Unemployment is

already effectively at 25%.

US Unemployed

The

number of people unemployed in the US peaked in October 2009 at 15,421,000.

There are now 2,921,000 fewer people unemployed in the country.

Unemployed

Persons

|

April

2012

|

Month/Month

|

Year/Year

|

National

|

12,500,000

|

-173,000

|

-1,292,000

|

And we know the actual unemployment is double

the reported number due to so many that have simply quit looking for jobs.

As of March

2012, debt held by the public was $10.85 trillion or approximately 70% GDP,

while the intragovernmental debt was $4.74 trillion or approximately 30% GDP.

These two amounts comprise the national debt of $15.6 trillion, roughly 100%

GDP.

Average credit card debt per household with credit card debt: $15,956 *

609.8 million credit cards held by U.S. consumers. (Source: "The Survey of Consumer Payment Choice," Federal Reserve Bank of Boston, January 2010)

Average APR on credit card with a balance on it: 12.78 percent, as of November 2011 (Source: Federal Reserve's G.19 report on consumer credit, released January 2012)

Total U.S. revolving debt (98 percent of which is made up of credit card debt): $801 billion, as of December 2011 (Source: Federal Reserve's G.19 report on consumer credit , released February 2012)

Total U.S. consumer debt: $2.5 trillion, as of December 2011 (Source: Federal Reserve's G.19 report on consumer credit, released February 2012)

The nation’s

homeless population 636,017 in 2011. The national rate of homelessness

was 21 homeless people per 10,000

About 11.1 million households, or 23.1

percent of all mortgaged homes, were underwater in the October-December

quarter, according to report released Tuesday by housing data firm CoreLogic.

That's up from 22.5 percent, or 10.8 million households, in the July-September

quarter.

GOOD GRIEF 23% of all mortgages are underwater? That means 23% of the homeowners are paying for a home worth less than the payments?

GOOD GRIEF 23% of all mortgages are underwater? That means 23% of the homeowners are paying for a home worth less than the payments?

Table 1. Number of people receiving Social Security, Supplemental Security Income, or both, March 2012 (in thousands)

| All beneficiaries | 61,273 | 53,111 | 5,384 | 2,778 |

|---|---|---|---|---|

| Aged 65 or older | 39,605 | 37,539 | 900 | 1,165 |

| Disabled, under age 65 a | 13,839 | 7,743 | 4,484 | 1,613 |

| Other b | 7,829 | 7,829 |

So if

the government defaults there will be 61 million people no longer able to

purchase food or pay bills to add to the 29 million on welfare and the 49

million using food stamps

After a while these numbers start to add up

49 million food stamps plus 61 million SSI

equals one third of the population.

It will not take that long for it to hit 50% as

things start to fall apart

And the REPUBLICANS are screwing around failing

to create jobs?

What do think will happen when all that credit

card debt defaults and all those Social Security checks run out and 23 percent

of homeowners stop paying their mortgages.

Does your job depend on customers - on people

having some money to buy whatever good or service you provide? Do you think you

and your family will be safe if suddenly 40 percent of the population starts

going hungry and the states and cities start to go broke and lay off the police

they can no longer afford.

Will they bring home the troops who are from poor

families - the blacks and Latinos and the poorer white kids who's families are

among the homeless and hungry. Who do you think they are going to protect?

How will you feel then about the Walton's who

have a combined wealth greater that 30% of the population among 6 individuals?

Once the collapse begins their wealth will be greater than 50% but the people

will no longer be shopping at Wal Mart. They will be occupying and eating

everything in Wal Mart.

I don't think you know how bad this can go. So

few people were armed back in the 30's but the NRA has taken care of that

problem. Homeless and hungry people with semi-automatic assault weapons are not

going to allow their kids to starve.

The oddest question asked by right winger's is

"I guess you think that is Bush's fault too?"

Asked as if there could be some sarcasm applied

to such an absurd question is goes unanswered because the answer is so

completely obvious. YES. YeS and YES I and we do.

But you should be relieved of another absurd

misconception - BUSH or W is just a catch word to describe the most damaging

government in US history. It has W's name on it but there is plenty of blame to

go around

We can blame Dick Cheney - who many believe was

more President than George

Or KARL ROVE - also known as Bush's Brain -

another pudgy chickenhawk who has no idea now when or if he is telling the

Truth - he's lied so much he has no clue

Then there is the majority in both houses of

Congress - and even the Democrats that went along with the plans devises and

authored by Republicans.

And of course we have to portion much of the

blame to the plethora of Republican "I can't Think Tanks" like the

Heritage Foundation and American Enterprise Institute - a list so long it could

fill and entire page. Add to that the wing nut radio people, Fox News, World

Net Daily, Michelle Malkin and a flood of winger blogs and media from

AmericanDinker to the Freepers. There is simply no shortage of idiots falling

all over themselves to reach for a piece of the Koch Brothers endless supply of

cash for cons.

No these are not CONSERVATIVES in any

respectable meaning of the word - these are the most radical and effective CONS

- con men the world has ever seen. They either Conned or stole enough votes and

support from the suckers who supported them to put themselves in a position to

steal such a huge portion of America' wealth they became thieves TOO BIG TO

JAIL.

The amassed wealth of the corporations, Wall

Street Financial houses, and wealthy individuals who have benefited from the

incredible redistribution of wealth - to the ultra wealth from the middle class

- have no shortage of cash to spend pushing any damn lie or distortion they can

conjure onto a gullible and fearful segment of wannabees while maintaining the

fiction that they give a damn about gay marriage or the right to life. All they

care about is the money and how much they can get their paws on.

It is all over now - we the people have lost -

our jobs, our money, our homes, our government and any real chance of ever

seeing any of it again in my lifetime. The weight of this is all too complete

and extreme - there is no correction for it. The only question that remains is

what will precipitate the ultimate collapse. Will it be climate change? water

and food shortages across the globe? a nuclear disaster? Peak Oil and the end

of energy? A situation where China calls in the debt? or the complete breakdown

of law and order when 30% of the work force is armed and unemployed and there

aren't enough prisons and the guards simply walk away turning loose the largest

prison population in the world when state and federal government can no longer

meet the payroll?

The system was never built to maintain under

this level of financial strain. With so much wealth in so few hands leaves too

many working aged males hungry and homeless with easy access to firearms the

question will become - when will police or military people find so many of

family and friends on the business end of their guns that they start to turn

around and fire in the opposite direction. When gasoline runs out or hits 6, 7

8 9 10 buck a gallon will people just start filling up and driving off? When the

credit cards of 50 60 percent are no longer paid and mortgage payments simply

end will there be enough law enforcement people willing to face armed home

"owners" who figure it's better to suffer suicide by cop - taking a

couple with them because they cannot attack the banks that find themselves

under constant assault?

It’s the financial stigma Republicans won’t talk about, and

average Americans won’t remember because it happened before last week.

It was the golden son, George W. Bush, who inherited a humming

economy and a surplus from his predecessor. Thanks to his bumbling, and that of

the two houses of Congress his party owned for six years⎯we squandered our

wealth and undercut our revenue base to the point where yahoos elected in a

reactionary wave to the appalling spending spree now threaten to ruin the

reputation of the country we all love. The only silver lining to the crash

having happened in late 2008 is that there is no way it can be blamed on his

successor⎯President Obama’s detractors have to content themselves with

attacking him for cleaning up the mess too slowly, and (horrors!) for spending

more money in the process.

Subscribe to:

Posts (Atom)